Grab up to 85% off on Acko Car Insurance plans

Save Big on Car Insurance with ACKO – Get Up to 85% Off!

Car insurance is essential, but it shouldn’t drain your wallet. With ACKO Car Insurance, you get up to 85% off and save as much as ₹40,000 on your new car’s insurance. Plus, enjoy a seamless, paperless experience with instant claim settlements. Why pay more when you can drive worry-free at a fraction of the cost?

Key features of ACKO’s two-wheeler insurance

1. Low Premiums – Pay Less, Get More

No need to pay extra for middlemen or commissions. Direct-to-customer pricing keeps costs low while providing full coverage. Save big without compromising protection.

2. No Paperwork – 100% Digital Process

Skip long forms and unnecessary documentation. Buy, renew, or claim insurance entirely online in just a few clicks. No need to visit an office or deal with physical paperwork.

3. Stress-Free Claims – Fast and Smooth Process

Filing a claim takes minutes. Enjoy free pickup and drop for repairs, track claims in real-time and receive quick settlements. (*T&C apply.)

4. Instant Claim Settlement – No More Waiting

Minor damages? Get settlements in hours. Major claims are processed swiftly according to policy terms. Quick payouts ensure no financial burden during unexpected situations.

5. Ultimate Convenience – Insurance Anytime, Anywhere

🔹 Buy insurance at midnight? Yes!

🔹 Renew a policy on a Sunday? Absolutely!

🔹 File a claim on a public holiday? No problem!

Manage everything online without restrictions.

6. 24/7 Support – Help Anytime Needed

Accidents don’t follow schedules, and neither does support. Get assistance anytime, anywhere. A dedicated team is available to help with policy queries and claims round the clock.

7. Quick Insurance Renewal – No Delays, No Stress

Renew car insurance effortlessly. Log in via the mobile app or website, enter policy details, and complete renewal instantly. Keep coverage active without last-minute hassles.

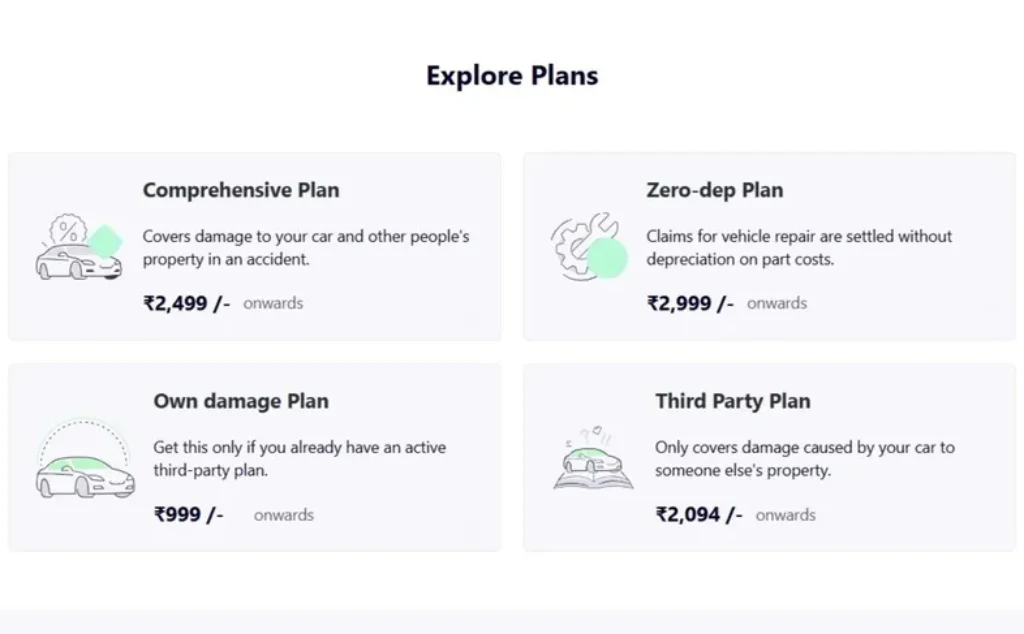

ACKO Car Insurance Plans – Affordable & Hassle-Free

ACKO offers four budget-friendly car insurance plans. Each plan is designed for different needs, ensuring you only pay for what matters.

1. Comprehensive Plan – Full Protection for Your Car

✅ Covers damages to your car and other people’s property.

💰 Price: ₹2,499/-

🚗 Ideal for: Car owners who want complete coverage and peace of mind.

2. Zero Depreciation Plan – Maximize Your Claim

✅ Claims are settled without depreciation deductions.

💰 Price: ₹2,999/-

🚗 Ideal for: New car owners who want maximum claim value.

3. Own Damage Plan – For Cars with Third-Party Insurance

✅ Covers damage to your car, but not third-party liability.

💰 Price: ₹999/-

🚗 Ideal for: Those with an existing third-party policy who want extra coverage.

4. Third-Party Plan – Basic, Legal Protection

✅ Covers damages caused to someone else’s property.

💰 Price: ₹2,094/-

🚗 Ideal for: Budget-conscious car owners who need basic legal coverage.

Why Choose ACKO Car Insurance?

1. 100% Paperless Process – No Hassles, No Delays

Skip the paperwork. With ACKO Car Insurance, you buy or renew your policy in minutes. No long forms, no unnecessary documents—just enter your details and get covered instantly.

2. Instant Claim Settlement – Get Paid in Just 2 Hours

Why wait weeks for claims? With ACKO’s fast-track claim process, minor damages are settled within 2 hours. Just upload pictures, answer a few questions, and get paid fast.

3. Lowest Prices – No Middlemen, Just Savings

ACKO eliminates agents and extra costs, passing the savings to you. That’s how you get low-cost plans without compromising on coverage.

Coverage under ACKO Car Insurance Online

Other Insurance Plans from ACKO

✔ Taxi Insurance – Protects commercial vehicles from accidents and damages.

✔ Bike Insurance – Secure your two-wheeler instantly. Learn more here

How to Buy ACKO Car Insurance in 3 Simple Steps

1️⃣ Visit ACKO Online – Enter your car details and choose a plan.

2️⃣ Make a Payment – Complete the secure transaction online (Debit Card/Credit Card/Net Banking/UPI).

3️⃣ Download Your Policy – Get instant confirmation and start driving worry-free.

Documents Required for Filing a Car Insurance Claim

No physical paperwork is required to raise a claim against your car insurance policy at ACKO. You must upload soft copies of the following documents through ACKO’s digital platform (mobile app/website). You may note that the exact list of required documents might vary depending on the claim.

- Driving Licence

- Car’s Registration Certificate

- First Information Report (FIR) (If required)

- Non-traceable Certificate (If required)

- Proof of identification of the policyholder

- Fire brigade report (If lodged)

- Original car purchase invoice (If opted for Return to Invoice add-on cover)

- Original repair bills

- Original payment receipts

How to Download Your Car Insurance Policy Copy

Step 1: Scroll to the top of this page to log in to your ACKO account using your mobile number.

Step: 2: Under your car insurance policy, click the “Policy Document” option and select “Download“ (you also have the option to email or receive it via Whatsapp) to get your car insurance policy copy.

Frequently Asked Questions (FAQs)

Is ACKO Car Insurance available for all types of vehicles?

How do I buy or renew my ACKO Car Insurance policy?

How fast is the claim settlement process?

What happens if my car gets stolen?

Can I customize my policy with add-ons?

Is ACKO Car Insurance valid outside India?

What documents do I need to file a claim?

Final Thoughts – Why Pay More?

ACKO makes car insurance easy, fast, and affordable. With discounts up to 85%, low-cost plans, and instant claim settlements, it’s the smart choice for car owners. Whether you need comprehensive protection or just third-party coverage, ACKO has a plan that fits your budget.